Research Startups

Research early, fast growing startups like these with aVenture

World Class Venture Research

aVenture brings public market-quality research to private markets. Get free access for longer by creating an account today.

Latest Company News

Fundraising Rounds

The Shape Sensing Company

Austin, US

Raised

—

Round

Series B

Investors

—

VectorShift

San Francisco, CA, US

Raised

$3M

Round

Seed

Investors

5

Simetrik

Bogota, CO

Raised

$55M

Round

Series B

Investors

8

Arini

San Francisco, CA, US

Raised

$500k

Round

Pre Seed

Investors

1

Authologic

Warsaw, MZ, PL

Raised

—

Round

Non Equity Assistance

Investors

1

Flower

Hamburg, HH, DE

Raised

$20M

Round

Series A

Investors

9

Armilla AI

Toronto, ON, CA

Raised

$4.5M

Round

Seed

Investors

7

Recent Research Reports

VC and Private Fund News

Risk and return across different asset classes

Source: Morgan Stanley (2020), “Public to Private Equity in the United States: A Long-Term Look”. Past performance does not ensure future results and expected risk, returns, or other projections may not reflect future performance. All asset classes correspond to the period 1984-2015, except for venture capital funds, which reflect the period 1984-2013, representing the most recent data available at the time of the study publication.

Venture Has Had Better Risk-Adjusted Returns

Since 1984, venture funds have exhibited comparable risk to some public and private equity investments, while potentially offering better returns.

High Growth Companies Are Often VC Investments

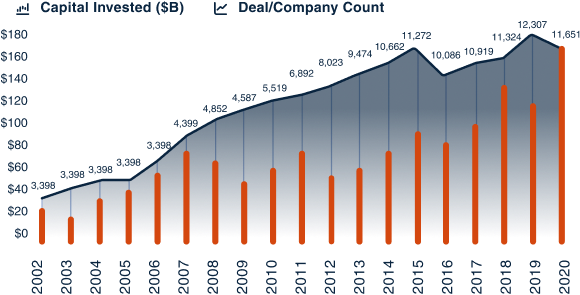

Since 2006, the number of deals and the capital raised have been growing exponentially, reaching a total of $164 billion invested across 11,651 deals in 2020 alone.

Venture capital investments over time

Source: NVCA, 2021. “NVCA 2021 Yearbook”, with underlying data provided by Pitchbook. Analysis period 2002-2020. The chart as displayed includes the total capital raised for each year in the VC asset class and the number of investments made by VC funds.