A better way

to invest

aVenture unlocks access to world changing start-ups with a diversified portfolio strategy that has historically outperformed stocks.

Join our waitlist for early access

Investing built for a better future

Long-term performance of venture capital compared to U.S. stocks

CA Venture Capital Index

S&P 500 Index

Sources: S&P 500 Index (TR); Cambridge Associates US Venture Capital Index, One Quarter Horizon Pooled Return through Q2 2020. The S&P 500 Index performance includes the impact of reinvested dividends by illustrating its total return. The Cambridge Associates US Venture Capital Index is net of fees, expenses, and carried interest. All investing involves risk, and an index cannot be invested in directly. Past performance does not ensure future results.

Venture capital has historically provided greater investment returns than stocks

Over the past 30 years, venture capital funds have earned approximately 300% more than the U.S. (public) stock market. Alongside its greater volatility, venture capital has proven to provide greater returns over the long-run. If you invested $10,000 in 1990 into a fund that tracked the CA Venture Capital Index, your investment would have been worth $775,000 in 2020, with the same investment tracking the S&P 500 growing to $226,000.

Venture capital has consistently and frequently outperformed public stocks

Since 2006, the number of deals and the capital raised have been growing exponentially, reaching a total of $164 billion invested across 11,651 deals in 2020 alone.

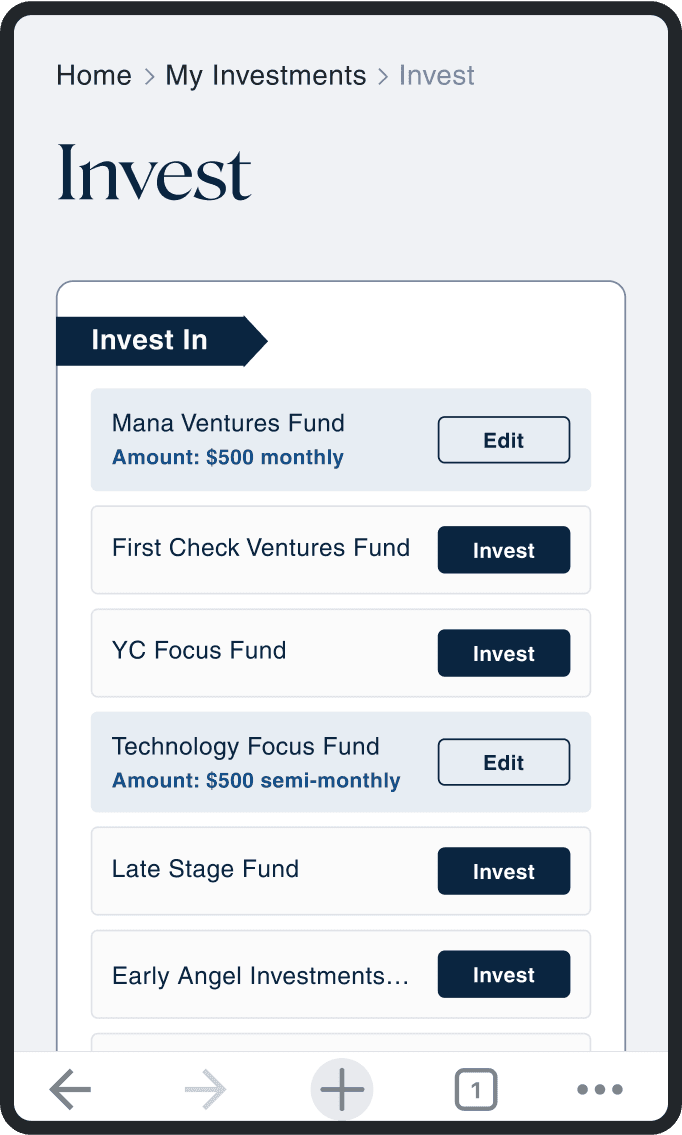

Why invest with aVenture?

Diversification

Invest across multiple industries, company sizes, locations, and more to reduce investment uncertainty. aVenture provides access to multiple funds with differing strategies and allocations, making it easier to diversify.

Easy investments and withdrawals

Data on start-ups and fund managers

FinTech

20 %

HealthTech

16 %

TMT

16 %

Life Sciences

14 %

SaaS

14 %

Other

10 %

PropTech

6 %

Consumer

2 %

AI/ML

1 %

IoT

1 %

Join the waitlist for early access

Frequently asked questions

I already manage a private fund. How can aVenture help me?

How is aVenture different from AngelList and similar options?

How do I launch a fund on aVenture?

Do I need to be experienced managing assets for others to be a fund manager?

I have other questions. Who can I contact?